-

CoinDesk

Coinbase's Base Sees Over $4B in Capital Outflows Through Cross-Chain Bridges; Ethereum Registers Inflows of $8.5B

Coinbase's Base Sees Over $4B in Capital Outflows Through Cross-Chain Bridges; Ethereum Registers Inflows of $8.5B

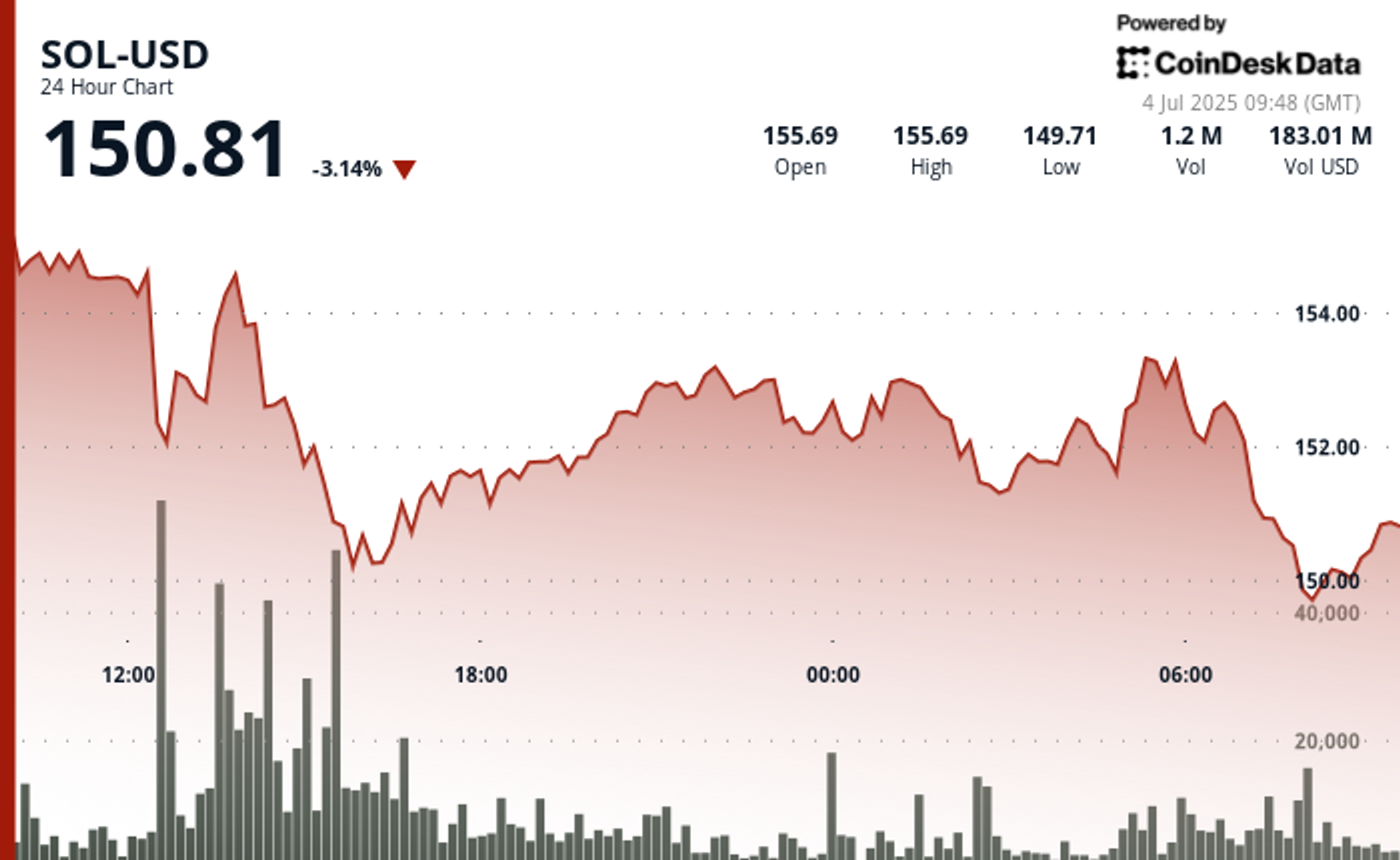

Coinbase's Layer 2 solution, Base, has experienced a net outflow of $4.3 billion this year, reversing its previous position as a top performer.